Social Commerce and E-Commerce Across the Globe: What to Expect Over the Next Six Years?

By Maris Naglis, VP of Customer Success in Infinity Hub The move to digitalisation has been one, if not the most, fundamental change that the world has seen in the past two years while battling the Covid-19 pandemic. Covid had a significant impact on e-commerce in particular, providing the opportunity to achieve 3 years’ worth of growth in only 3 months. This growth is now expected to remain steady, it’s up to marketers and e-sellers to find ways of keeping up with the pace and remain at the forefront.

2.45 billion consumers are classed as digital buyers. Why?

That’s right, 2.45 billion consumers! It may sound like an unfathomable number, but it is representative of the number of people worldwide who purchased online in 2021. According to eMarketer, this represents 58% of connected users, and 32% of the total population. In other words, 1 out of 3 people globally would be categorised as a digital buyer in 2021. This number is expected to rise to more than 12% (2.75 billion) in the next 4 years.

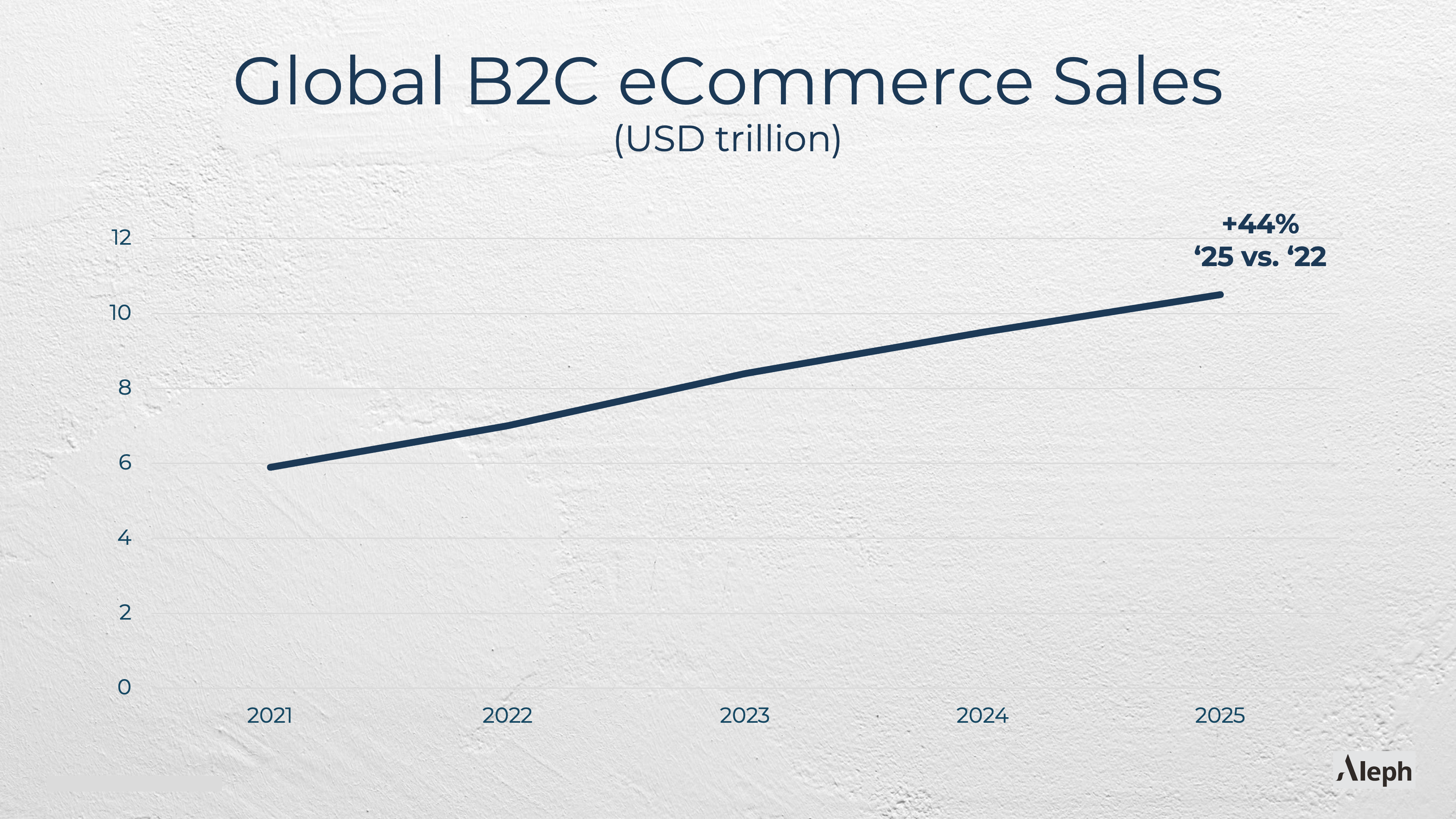

The growth of eCommerce is expected to reach 44% in 3 years, across sales, revenues, business models, and industries, achieving 10.4 trillion USD in 2025 with a relatively steady annual growth rate of 15%.

Most digital buyers are in Asia, however the biggest opportunity is in Central Europe!

The largest number of digital buyers are based within the Asia-Pacific region, due to their sheer population size in comparison to the rest of the world. However, looking at the share of internet users that buy online, North America takes the leading position with 83% of all internet users having shopped online, followed by Western Europeans at 79%.

Asia-Pacific has a substantial margin for growth in terms of digital buyers with a current figure of 73%. This increase will however only be realised when internet access is improved across all the regions, and those users with internet access begin their digital shopping journey (only 58% of the total global population is connected to the Internet).

Western Europe and Latin America have similar digital buyer numbers. However, Western Europe achieves higher penetration rates in terms of total population, thus their market is more mature than that of Latin America, and this region is the one that shows the most growth. While regional growth is 3.9% on average, LATAM will grow by + 7.6% year-on-year.

Central and Eastern Europe both hold substantial opportunities, as over half of the users in these regions already purchase online. Thus, as the percentage of users adopting this method increases, results will scale, and improvements will be made to delivery times, and the quality of available online products.

The Middle East and Africa make up 104 million digital buyers, slightly more than 4% of the total. The lower percentage is result of various barriers evident across these regions, such as the low adoption of purchase type (40% of Internet users buy online), and access to the Internet (this is the lowest registered access levels with only 24% digital penetration in 2021).

Mobile penetration is skyrocketing

Smartphone penetration grew by 227% in the last 10 years, with continued growth expected, presently 44% of the total population has a Smartphone. North American and Western Europe show higher penetration (more than 70%), Central and Eastern Europe is the 3rd region with almost 58%, then Asia-Pacific and Latin America have an average of 50%. The region producing the lowest penetration overall is the Middle East and Africa, with only 1 in 10 owning a smartphone.

In contrast, Latin America has shown the fastest overall growth in recent years with +370%. Closely followed by Central and Eastern Europe (+344%), and Asia-Pacific (+269%). Those regions with higher penetration rates achieved slightly higher growth, but with mature markets, the annual average growth is 0.60%, wherein other regions, exceed 1.5% by year.

It is clear that smartphone penetration triggers an improvement in e-commerce, it denotes two aspects: purchasing power and mobile capacity.

In emerging regions, access to a device demonstrates purchasing power. Thus, looking at the number of users (see table below) could be a useful factor when analysing the total addressable target market.

The clear benefits of mobile penetration on eCommerce necessitates a rethink in regard to the moment of purchase, the inspiration, and leisure of users. The purchase patterns of users are no longer traditional, with purchases occurring throughout the entire day.

The Journey of Mobile Shopping Continues

Whilst Mobile commerce is continuing its growth and clear benefits are evident, it still remains underdeveloped, with only 2 out of 10 internet users following through to purchase completion via smartphone.

Statistics show that users are more likely to use their smartphone during the research phase, but once they are satisfied with their findings, most move across to a laptop or PC to finalise the payment.

As can be seen from the above chart, Latin America has the highest number of mobile shoppers (24% or Internet users), with the Middle East and Africa coming in lowest (15% of internet users). The figures of the Asia-Pacific region are also considered high, although this can be partly attributed to the higher reliability on smartphones day to day, including browsing for news and entertainment through social media, as well as brand interaction and active purchasing through platforms such as Facebook.

Online shopping transcends generations

On average globally, social media is in the top 4 channels used for discovering a brand or product. Whilst TV ads, search engines, and word-of-mouth still take the top spots, as most used across the total population.

However, results vary when looking at Generation Z aged between 16-24. In this category of user, social media becomes the main source of discovery, across all regions. This denotes the globalisation of media consumption, and the adoption of social networks as a supreme media, to achieve awareness of products or services, up to + 13% than search engines and ads seen on TV.

Latin America exceeds the average of 18% in social media, versus other media forms as a preferred channel to discover brands. Although TV ads feature high results in the Middle East and Africa, users aged between 16-24 continue to prioritise social media.

There is a common myth amongst internet users that “digital buying is only for young people”. This statement is thankfully soon to be eradicated, as the gap between the share of youth e-shoppers and their older counterparts no longer exists.

In fact, people between the ages of 25 and 44 lead in digital shopping, with their younger friend Generation Z tailing them closely, even though many of them are yet to receive their first paycheck!

Effectiveness and technology will remain key trends in eCommerce

With an increased visibility, growth of e-commerce, its attractiveness and technological challenges including privacy and data tracking, evaluation of the effectiveness of marketing campaigns will remain at the forefront of minds of digital advertisers. As we enter into a cookieless future, this challenge will need to be tackled blindly as we enter into a reality that no one has faced before.

Additionally, larger and stronger competition among e-commerce platforms will not only contribute to the growth of the landscape, but also the users acquisition rate. Therefore, advertising and marketing strategies have become ever more important. Advertisers will have to put all their focus on what they do, how they do it, and where they put their attention and money.

Measuring results and adapting campaigns based on data will also remain key to success. And here, the winning formula is the use of the right technologies that help evaluate the results both in a speedy and effective manner.

There are two main reasons to develop and use technology in digital marketing for e-commerce. Firstly, to unlock the ability to scale globally and unlock the possibility to e-market (domestically). And secondly, to understand when to scale and what to scale, and overcome speculations and estimations that marketers currently have to rely on.